Ad hoc announcement pursuant to Art. 53 LR

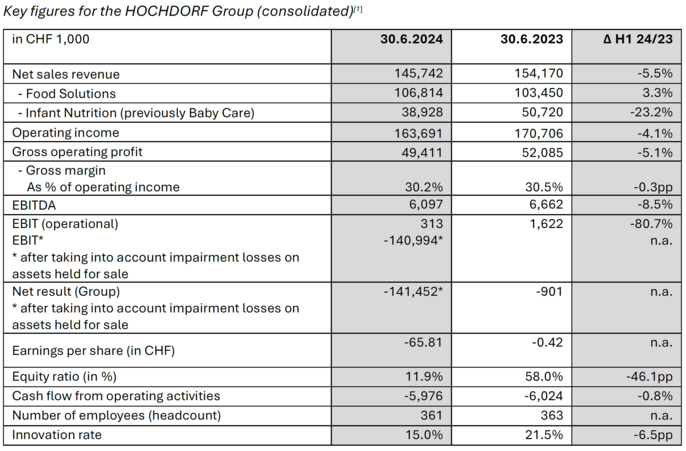

Hochdorf, 27 August 2024 – Following its positive EBITDA at the end of 2023, the HOCHDORF Group has achieved a further goal: a positive operating EBIT in the first half of 2024. Despite lower sales volumes in “Infant Nutrition”, gross margin remained stable at 30.2% (previous year: 30.5%). The agreed sale of the HOCHDORF Swiss Nutrition Ltd (HSN) subsidiary leads to considerable impairments due to the legacy financial burdens and a net accounting loss of CHF 141.5 million.

The HOCHDORF Group is publishing its 2024 half-year results today, earlier than planned. In a separate media release also issued today, the Group announced that an agreement was signed for the sale of HSN to AS Equity Partners. The completion of the transaction is subject, among others, to the approval of the shareholders of Hochdorf Holding Ltd at an Extraordinary General Meeting on 18 September 2024. Hochdorf Holding has been granted a provisional debt-restructuring moratorium.

Operational turnaround on track

Net sales revenue was CHF 145.7 million in the first half of 2024 (-5.5% compared to the first half of 2023). The “Food Solutions” division contributed CHF 106.8 million to the net sales revenue, representing a 3.3% increase compared to the prior-year period. Net sales in “Infant Nutrition” dropped by 23.2% to CHF 38.9 million as deliveries to a customer were temporarily below budgeted volumes.

Despite the lower volumes in the “Infant Nutrition” division, the gross margin remained stable at 30.2% (H1 2023: 30.5%).

An easing of market conditions for energy and logistics contributed to a further stabilization of the costs and better planning reliability, while allowing further improvements to the operational efficiency. Despite oversupply, prices remain high on the Swiss milk market, which is reinforced by a further increase in the target milk price from 1 July. In view of this situation, HOCHDORF is pursuing a consistent strategy of contract processing for milk regulation. To mitigate against commercial risk, milk segmentation is aligned with confirmed demand only. Continuing the downward trend, raw material costs were reduced by 3.7% to CHF 114.3 million. Personnel expenses remained constant at the level of 2023, while other operational expenses could be reduced.

At CHF 6.1 million, EBITDA was slightly lower than in the first half of 2023 (CHF 6.7 million). Operationally, the HOCHDORF Group achieved a positive EBIT of CHF 0.3 million thanks to further cost discipline and a competitive product and price mix.

Agreed sale of HSN leads to accounting loss

With the agreed sale of HSN, this subsidiary is recognised at liquidation values in the HOCHDORF Group’s half-year financial statements. Due to the legacy financial burdens, this led to an impairment of CHF 141.3 million compared to book values. As a result, HOCHDORF Group reported an accounting net loss of CHF 141.5 million.

Over-Indebtedness of HOCHDORF Holding

In the balance sheet of HOCHDORF Holding as at 30 June 2024, the intercompany loans granted to HSN years ago amounting to CHF 182 million had to be written off in full due to the agreed sale. This resulted in over-indebtedness in the standalone financial statements of HOCHDORF Holding in accordance with Art. 725b of the Swiss Code of Obligations.

Outlook

HSN’s operational business will continue without interruption and HSN will not be affected by the debt restructuring proceedings of HOCHDORF Holding. As the future owner, it is AS Equity Partners' intention that upon completion of the transaction, the existing management under CEO Ralph Siegl will continue to run the business and drive forward the transformation.

The creditors of HOCHDORF Holding will be informed in due course in coordination with the administrator as part of the upcoming debt restructuring proceedings and do not need to take any action at this point in time. At the Extraordinary General Meeting, the renaming of HOCHDORF Holding and the delisting of the company’s shares will be proposed to shareholders.

Material to download and further information

- Interim Report online: https://report.hochdorf.com/2024/hyr/ (in German)

- Interim Report as PDF: https://report.hochdorf.com/2024/hyr/downloads/de/Hochdorf_Halbjahresbericht_2024.pdf (in German)

- Presentation of the Interim Results: 27 August 2024, 10-11am, link for participation: https://event.choruscall.com/mediaframe/webcast.html?webcastid=GQWk4oKb

- Media releases by e-mail / Investor News Service: https://www.hochdorf.com/en/newsletter

- Overview of ad hoc press releases of the HOCHDORF Group: https://www.hochdorf.com/en/media/ad-hoc-announcements/

- Picture material: on request / Keystone: https://visual.keystone-sda.ch/lightbox/-/lightbox/page/2047447/1

Dates

- 18 September 2024: Extraordinary General Meeting, informations and invitation: https://www.hochdorf.com/gv2024/

Contact and photo material

HOCHDORF Holding Ltd

Marlène Betschart, Head of Corporate Communications & Investor Relations

+41 41 914 65 83 / +41 79 245 24 10

marlene.betschart@hochdorf.com

[1] Non-GAAP measures are shown in the Annual Report in the Notes to the 2023 consolidated financial statements of the HOCHDORF Group, note 32: report.hochdorf.com/2023/ar/en/appendix-of-the-consolidated-financial-report-2023-of-the-hochdorf-group